Content

It lists the company’s assets, liabilities, and equity, and the financial statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt. Financial accounting is the practice of recording and aggregating financial transactions into financial statements. The intent of financial accounting is to distribute a standard set of financial information to outside users of the information, such as creditors, lenders, and investors.

As per this equation, the assets of a business are always equal to the claims of owners and outsiders. Now, the dual effect of every transaction impacts this equation in such a way that both sides are https://www.bookstime.com/ equal at all times. Thus, financial accounting involves the reporting of accurate, reliable and timely information of the entity’s operating profit and financial position to its various stakeholders.

Balance Sheet

Students learn to use the accounting equation and are introduced to the four major financial statements. Additional topics include ethical considerations, recording business transactions, and the application of credit/debit rules. Financial accounting is important for businesses because it helps them keep track of their financial transactions. In addition, financial accounting helps you communicate accounting definition your business finances to outside parties such as creditors and investors. The financial statements generated provide all the necessary information to other parties, which will either encourage or discourage them from partnering with your business. The trial balance, which is usually prepared using the double-entry accounting system, forms the basis for preparing the financial statements.

If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page. Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. Commerce Mates is a free resource site that presents a collection of accounting, banking, business management, economics, finance, human resource, investment, marketing, and others. Asset, expense, and dividend accounts have normal debit balances (i.e., debiting these types of accounts increases them).

Users of Financial Accounting/Financial Statements

It explains few of the changes in the assets, liabilities and equity of an entity between two consecutive balance sheets. Further, it provides information relating to return on investment, risk, financial flexibility, and operating capabilities. Thus, the information regarding the results achieved by an entity during a specified period of time are in terms of assets and liabilities, which provide the basis for taking decisions. The financial statements help in evaluating the performance of a business only when such results can be compared over a period of time. To know the financial performance and position of the business, a business owner is required to prepare financial statements at the end of a specific period.

- Click here to know more about these financial statements and steps to how to prepare it.

- The statements are considered external because they are given to people outside of the company, with the primary recipients being owners/stockholders, as well as certain lenders.

- After all, how hard can it be to simply record how much money your business made and how much it spent?

- On the flip side, it doesn’t depict the actual cash flow and can have terrible consequences if you are not keen.

- In the example above, the consulting firm would have recorded $1,000 of consulting revenue when it received the payment.

Private companies may follow GAAP or prepare financial statements based on another comprehensive basis of accounting, such as tax-basis or cash-basis financial statements. The accrual method of financial accounting records transactions independently of cash usage. Revenue is recorded when it is earned (when a bill is sent), not when it actually arrives (when the bill is paid). Accrual accounting recognizes the impact of a transaction over a period of time. An income statement can be useful to management, but managerial accounting gives a company better insight into production and pricing strategies compared with financial accounting.

Ascertaining Financial Position

The accounting standards are important because they allow all stakeholders and shareholders to easily understand and interpret the reported financial statements from year to year. Financial statements must conform to accounting standards and legal requirements. In the U.S., the Financial Accounting Standards Board (FASB) establishes financial accounting and reporting standards (generally accepted accounting principles, or GAAP).

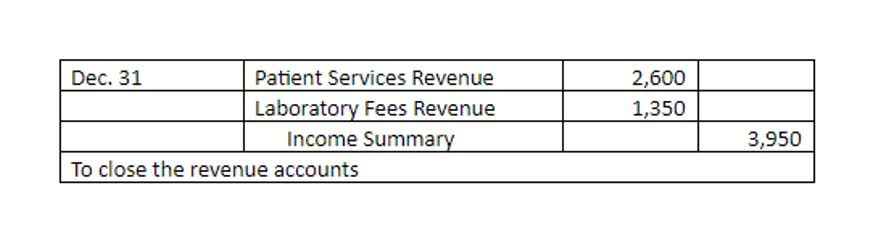

In one account, the transaction is recorded as a debit while in another it is recorded as a credit. Debit entries account for an increase in assets (what you own) and expenses (what you spend), and a decrease in liability, equity, and income. On the other hand, credit entries account for a decrease in assets and expenses and an increase in liability (what you owe), equity, and income (what you receive). Financial accounting is the process of preparing financial statements that companies’ use to show their financial performance and position to people outside the company, Including investors, creditors, suppliers, and customers. The income statement details the net income for the business over the specified time period.

The figures in your reports will look different depending on whether you use cash or accrual basis accounting. After you enter a transaction and categorize it under an account, your accounting software will create a journal entry behind the scenes. Most modern accounting software uses the double-entry accounting system, which requires two book entries — one debit and one credit — for every business transaction.

- The end result is a financial report that communicates the amount of revenue recognized in a given period.

- Finance is termed as lifeline of business activities and its management is quite important for every organisation.

- The Financial Accounting Standards Board voted to set a new rule on cryptocurrency accounting and disclosure, changes companies holding these assets have argued more accurately reflect their financial condition.

- The income statement is prepared keeping into consideration two primary accounting principles.

- Higher retained earnings values indicate the company has plenty of cash on hand to finance new initiatives and growth, which is attractive to investors.